Hands holding a digital representation of a crypto wallet with assets secured in that location

Crypto Wallets: Keep Your Crypto Assets Safe

In Brief

- • Crypto wallets protect the private keys that give you full control over your digital assets.

- • Hot, cold, custodial, and non-custodial wallets each serve different purposes, with security increasing as convenience decreases.

- • Proper wallet security habits, especially protecting seed phrases, are essential due to crypto transactions being irreversible.

Understanding wallet basics is the single most important step toward safe participation in the crypto ecosystem. A wallet is not just a tool for storage, it’s the foundation of your financial independence in the digital age.

Crypto represents a radical departure from traditional finance, offering decentralization, transparency, and financial sovereignty. Yet, this freedom also means there is no safety net.

If you lose access to your wallet, there is no customer service hotline to call, no “forgot password” button to click, and no institution to reverse a mistaken transaction.

In crypto, you must act as your own bank when it comes to the safety of your assets. Empowerment is thrilling, but it also means that the security of your funds depends entirely on how well you manage your finances.

What Is a Crypto Wallet?

At its core, a crypto wallet isn’t a container for coins. Instead, it’s a digital tool that stores the private keys you need to access and manage your cryptocurrency.

The blockchain itself holds the record of your coins, but your wallet’s the interface that allows you to prove ownership and perform transactions with your funds.

Every wallet operates with a public and a private key. The public key, often referred to as your wallet address, is comparable to your bank account number. On the other hand, a private key is like your ATM PIN. It must remain secret at all times because it gives access to control your funds.

Beginners often confuse the wallet with the coins themselves, but in reality, the wallet is simply the access point. Therefore, the blockchain is the ledger, and the wallet is the key that unlocks your portion of it.

Types of Wallets

There are several types of wallets, each with its own strengths and weaknesses. Understanding these categories will help you choose the right one for your needs.

Hot Wallets

Hot wallets are connected to the internet. They are typically apps, browser extensions, or desktop software. Popular examples include MetaMask, Trust Wallet, and Coinbase Wallet.

Hot wallets are convenient and user-friendly, making them ideal for beginners who want to experiment with small amounts of crypto. Moreover, they allow for fast transactions and easy access, but this convenience comes at a cost.

Because they are online, hot wallets are vulnerable to hacks, phishing, and malware.

Cold Wallets

Cold wallets are offline storage solutions. They include hardware wallets such as Ledger and Trezor, or even paper wallets where keys are printed and stored physically.

Because they are not connected to the internet, cold wallets are far less vulnerable to cyberattacks. They are extremely secure, making them ideal for long-term storage and large holdings.

Cold wallets protect your assets from theft, but they are less practical for everyday spending. If you plan to hold crypto for the long term, a cold wallet is essential. It requires a bit more effort to set up and use, but the peace of mind is worth it.

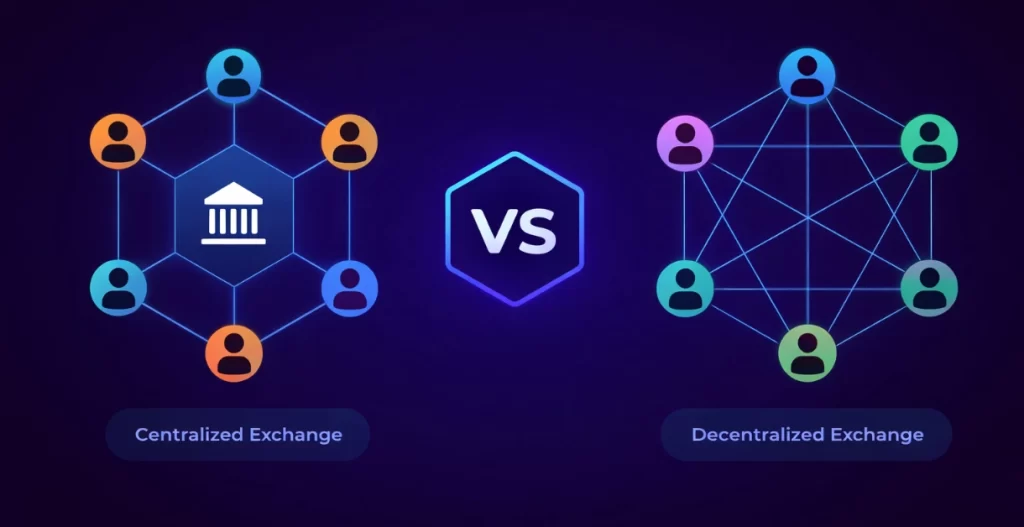

Custodial Wallets

These are managed by exchanges or third parties. When you create an account on platforms like Binance or Coinbase, the platform controls your private keys.

This makes custodial wallets simple to set up and beginner-friendly, but it also means you do not truly own your crypto. If the exchange is hacked or closes itsoperations, your funds are at risk.

Custodial wallets are like storing money in a bank. Indeed, you trust them to guard it, but you don’t have ultimate control. For beginners experimenting with small amounts, custodial wallets can be a convenient starting point. However, seasoned investors might not see it as a long-term solution.

Non-Custodial Wallets

Non-custodial wallets give you full control over your private keys. You are responsible for security, backups, and recovery. However, this requires more responsibility and awareness, in exchange for true ownership and greater security.

Non-custodial wallets embody the true meaning of financial independence with personal responsibility.

Setting Up Your First Wallet

The process typically involves choosing your wallet type, downloading the software or purchasing the hardware, and opening your wallet. Moreover, when you create a wallet, you will be given a seed phrase, a list of 12 to 24 words that serves as a backup.

This seed phrase is the master key to your wallet. If you lose it, you lose access to your funds.

The most important rule is to never store your seed phrase digitally. Therefore, avoid taking a screenshot, saving it in cloud storage, and emailing it to yourself. Many experienced users keep multiple backups in different places to protect against loss or theft.

Once your wallet is set up, enable security features such as strong passwords, Two-Factor Authentication (2FA), and biometric locks when available.

Best Practices for Beginners

Owning crypto means you’re partially becoming your own bank. Therefore, you must develop a security mindset to keep your holdings safe. Always remember the mantra: “Not your keys, not your coins.” If you don’t control the private keys, you don’t truly own the assets.

Avoid public Wi-Fi connections, as hackers can intercept wallet activity on unsecured networks. Also, update your wallet apps and hardware regularly to protect against vulnerabilities.

Beginners should be especially cautious about leaving large amounts of crypto on exchanges, as it can expose their portfolio to unnecessary risks. Also, be vigilant to not fall for “support staff” scams on social media, as these scams can wipe out your holdings in seconds.

By learning from these habits, you can avoid costly mistakes and build a strong foundation for your crypto journey.

Security at the Forefront

Technology alone can’t protect you. Therefore, beginners should cultivate habits such as skepticism toward unsolicited messages, storing and managing keys appropriately, and having the discipline to keep backups and multiple layers of security added to their accounts.

Crypto rewards those who take responsibility and keep their accounts protected at all times. By treating your wallet as the cornerstone of your financial independence, you build resilience against the risks that come with decentralization.

By understanding the differences between the different types of wallets and by practicing good security measures, you’ll be ready to deal with the unpredictability that surrounds the crypto sphere.

Frequently Asked Questions

Cold wallets, such as hardware wallets, are the safest option because they store private keys offline and are far less vulnerable to hacks.

No. If an exchange controls the private keys, you don’t fully own the crypto and are exposed to platform risk.

You permanently lose access to your funds, as there is no recovery service or password reset in crypto.

Hot wallets are safe for small amounts and daily use, but they carry higher risk because they are connected to the internet.

Storing seed phrases digitally or sharing them with fake support accounts, which almost always leads to theft.

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

Peter Schiff Warns of a U.S. Dollar Collapse Far Worse Than 2008

2Dubai Insurance Launches Crypto Wallet for Premium Payments & Claims

3XRP Whales Buy The Dip While Price Goes Nowhere

4Samsung crushes Apple with over 700 million more smartphones shipped in a decade

5Luxury Meets Hash Power: This $40K Watch Actually Mines Bitcoin

Latest

Also read

Similar stories you might like.