Bitcoin “To the Glue Factory” Peter Schiff Doubles Down

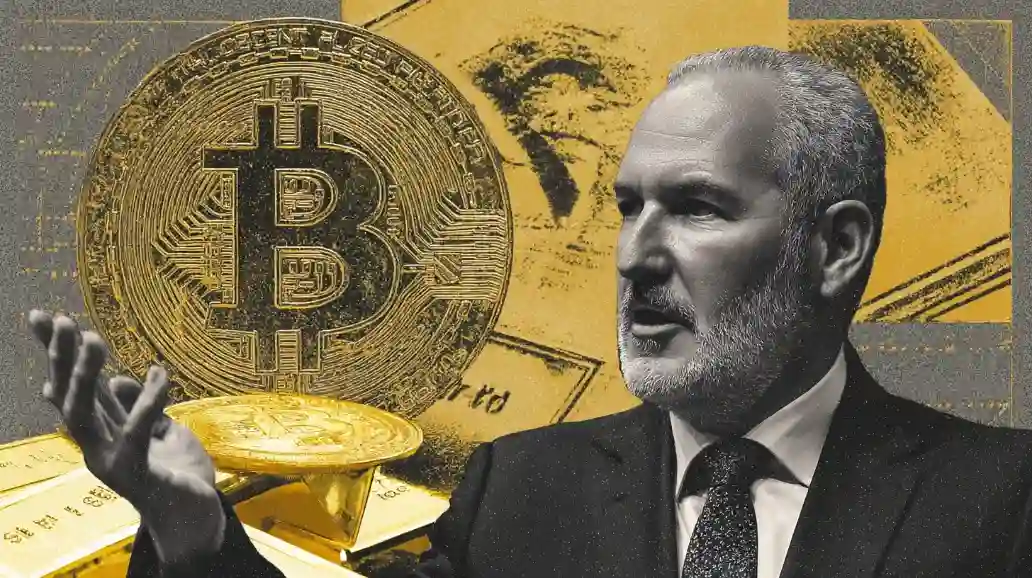

Bitcoin “To the Glue Factory”? Peter Schiff Doubles Down

In Brief

- • Peter Schiff warns Bitcoin may be nearing a major breakdown.

- • He argues BTC behaves like a speculative asset, not a safe haven.

- • Schiff believes leverage and weak demand could amplify any sell-off.

Peter Schiff is back with another warning for Bitcoin (BTC) holders, arguing the cryptocurrency market is nearing a major breakdown and that many investors are dangerously complacent.

In his latest episode of The Peter Schiff Show, which was streamed on December 18, Schiff says Bitcoin’s recent weakness, especially when measured against gold, signals the market may have already peaked for this cycle. As he said:

“I think that we are very, very close to a meltdown, a big crash in Bitcoin. (…) Bitcoin is going to go down at least to $50,000.”

Schiff frames Bitcoin’s core problem as structural. In his view, it’s not a defensive asset like gold, but a speculative trade that thrives on liquidity, hype, and leverage.

He claims the ‘Bitcoin president’ narrative, talks of strategic reserves, and the rise of corporate ‘Bitcoin treasury’ copycats helped fuel optimism earlier this year, but failed to deliver sustained upside.

If Bitcoin couldn’t push higher with that much perceived tailwind, he argues, it may struggle even more as sentiment cools.

Schiff’s Bitcoin Crash Scenario

A key part of Schiff’s thesis centers on MicroStrategy, which he points to as a canary in the coal mine. He says the stock’s weakness suggests a larger unwind is coming and predicts Bitcoin could fall to at least $50,000 if selling accelerates. According to him:

“It’s hard to find a worse-looking chart than MicroStrategy. (…) And there’s no way that MicroStrategy stock is going to go down by 50% and Bitcoin not go down.”

More importantly, Schiff argues that $50,000 isn’t a ‘safe’ level. He portrays it as a trigger point where loans backed by BTC collateral could start hitting margin-call territory, forcing borrowers to post more collateral or liquidate.

“[Bitcoin] is horrible collateral. We’re going to find that out. (…) My thinking is that below $50,000 is when a lot of these margin calls are going to get triggered.”

As he sees it, that’s where a cascade begins in the form of forced selling from over-leveraged holders, followed by exchange-traded fund (ETF) investors who aren’t committed long-term and may rush for the exits once volatility spikes.

Schiff argues there may be fewer natural buyers willing to absorb the selling pressure, claiming whales have already been distributing into strength.

Why Schiff Believes It Could Spread Beyond Crypto

Schiff also warns that a sharp Bitcoin drawdown wouldn’t stay contained. He believes a crash could create broader economic stress through second-order effects like layoffs at crypto firms, losses for lenders that accepted BTC as collateral, and legal blowback from retirees who bought Bitcoin exposure through IRA products.

His bottom line is consistent with his long-running stance. If investors want protection from a potential dollar crisis, Schiff says they should choose gold and silver, not Bitcoin. He claims many bought BTC as a hedge against currency debasement, but will be “surprised” when Bitcoin drops first in a risk-off environment.

“If they wanted protection, they should have bought gold or silver. (…) [Bitcoin] is out in the pasture, but pretty soon, it’s going to be in the glue factory. (…) I do think we’re going to have a dollar crisis, but the Bitcoin crisis is going to happen first.”

Meanwhile, Bitcoin was at press time trading at $87,958.86, up 0.44% on the day, down 4.79% across the week, and losing 4.04% over the past month, according to the most recent price chart information.

Whether or not his exact price targets play out, Schiff’s message is clear. He sees Bitcoin’s risk-reward skewed to the downside and believes the smart move is to de-risk before leverage-driven selling turns an ordinary correction into a full-blown liquidation event.

More Must-Reads:

How do you rate this article?

Subscribe to our YouTube channel for crypto market insights and educational videos.

Join our Socials

Briefly, clearly and without noise – get the most important crypto news and market insights first.

Most Read Today

Peter Schiff Warns of a U.S. Dollar Collapse Far Worse Than 2008

2Samsung crushes Apple with over 700 million more smartphones shipped in a decade

3Dubai Insurance Launches Crypto Wallet for Premium Payments & Claims

4XRP Whales Buy The Dip While Price Goes Nowhere

5Luxury Meets Hash Power: This $40K Watch Actually Mines Bitcoin

Latest

Also read

Similar stories you might like.